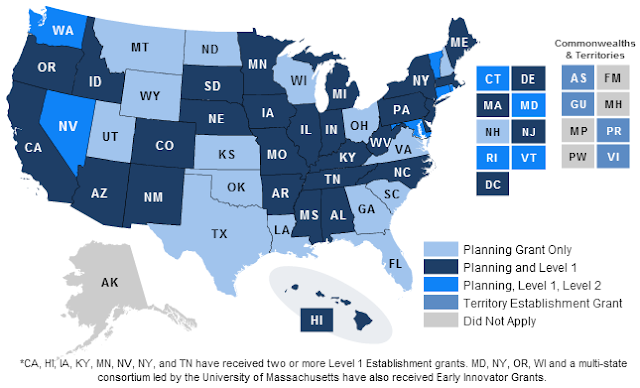

Map: Afordable Health Care Plan Implimentation. Credit: U.S. HHS

FROM: U.S. SENATOR DEBBIE STABENOW'S WEB SITE

Affordable Health Coverage for Michigan Businesses

Affordable Coverage for Michigan Businesses

132,000 small businesses in Michigan may be eligible for the new small business tax credit that makes it easier for businesses to provide coverage to their workers and makes premiums more affordable. Small businesses pay, on average, 18 percent more than large businesses for the same coverage, and health insurance premiums have gone up three times faster than wages in the past 10 years. This tax credit is just the first step towards bringing those costs down and making coverage affordable for small businesses.

From 2010 through 2013, businesses with fewer than 25 full-time employees that contribute at least 50% of the total premium will be eligible for tax credits of up to 35% of the employer contribution. The full credit will be available for businesses with fewer than 10 employees averaging less than $25,000 annual wages, and phase out at $50,000. Nonprofit organizations will qualify for tax credits of up to 25% of the employer contribution during this time period.

Beginning in 2014, eligible small businesses purchasing coverage via an exchange will receive tax credits of up to 50% of the employer contribution if the employer provides at least 50% of the premium cost. Nonprofit organizations will qualify for tax credits of up to 35% of the employer contribution during this time period. Seasonal employees will not be counted when determining eligibility. A business can claim the credit for any two years in the future.

Employer Responsibility

Employers will not be required to offer health insurance. Only those employers with more than 50 employees who don't provide coverage will have to contribute toward the cost of covering the employee if the employee qualifies for a tax credit.

Employers with more than 50 employees who don't offer coverage and have at least one full-time employee who receives a premium tax credit will have to contribute $2,000 per full-time employee. No contribution is required during an employee's waiting period to qualify for health care (up to 60 days). Part-time employees are counted differently from full-time employees.

There is a transition provision that subtracts the first 30 employees (e.g., a firm with 51 workers that does not offer coverage would pay an amount equal to 51-30, or 21, times the applicable per-employee payment amount).